Understanding Home Warranty Coverage for Foundation Repair: What Homeowners Need to Know

Introduction: The Truth About Home Warranty and Foundation Repair

Homeowners often wonder whether their home warranty covers costly foundation repairs . Foundation issues can threaten the structural integrity of your home, leading to expensive and disruptive fixes. Despite the gravity of these repairs, most standard home warranty plans do not cover foundation damage . Understanding why this is the case-and knowing your options for protection-is essential for making informed decisions and safeguarding your property investment. [2] [4]

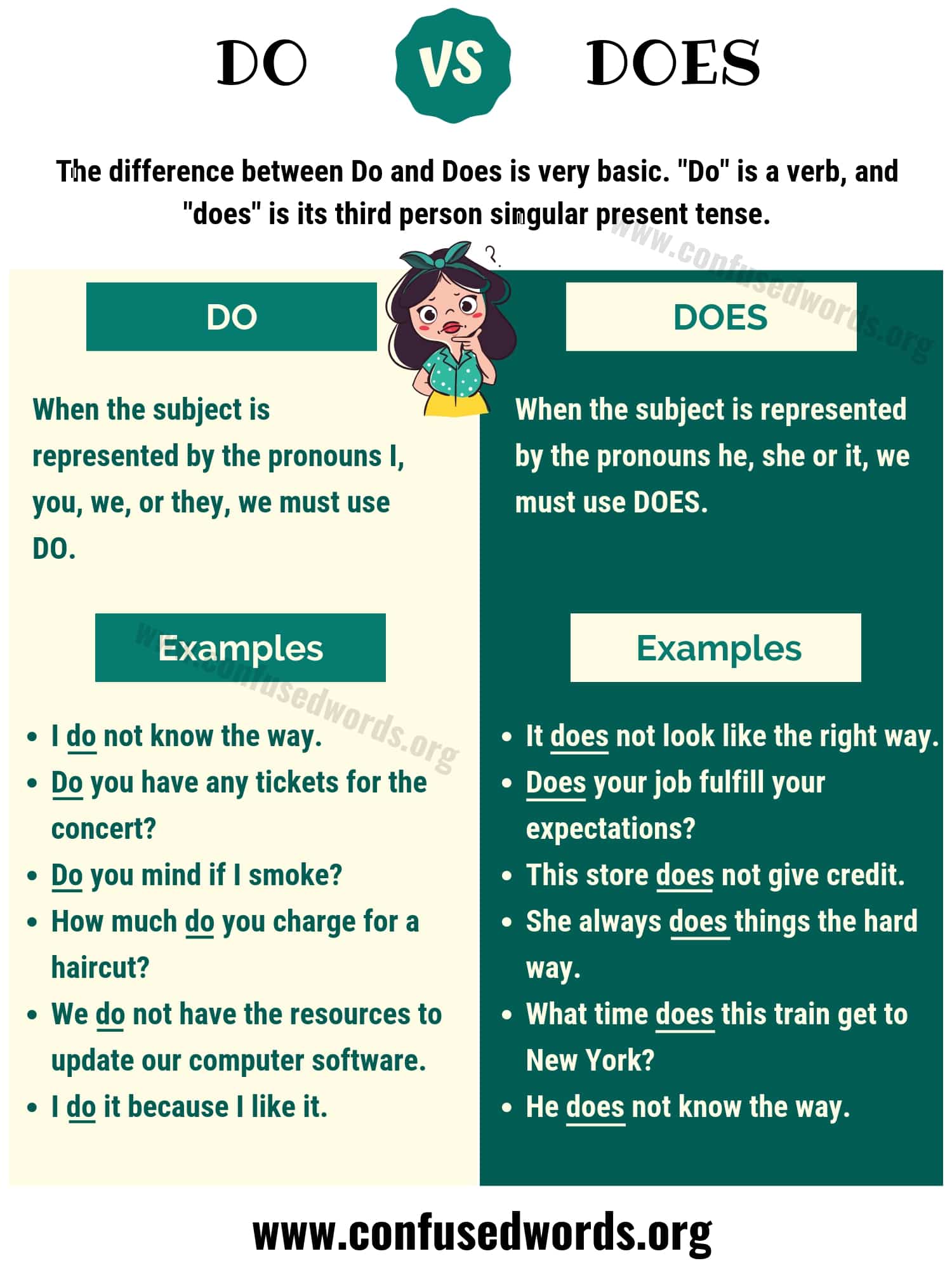

Section 1: Why Standard Home Warranties Exclude Foundation Repairs

Home warranty contracts are designed to cover the repair or replacement of major appliances and mechanical home systems that fail due to normal wear and tear. These typically include HVAC systems, water heaters, plumbing, kitchen appliances, and sometimes electrical systems. The foundation , however, is classified as a structural component rather than a mechanical system. This distinction is why most home warranty providers exclude foundation repairs from their standard plans. [2] [4]

Structural issues like foundation damage are commonly caused by environmental factors such as soil movement, poor drainage, tree roots, or construction defects-all problems that extend beyond the scope of normal appliance or system wear and tear. [4]

Example:

If your home warranty covers plumbing and a burst pipe damages your foundation, the warranty will usually pay for the pipe repair-

not

the associated foundation damage.

[2]

Section 2: Builder’s Warranties and New Home Protection

If you own a newly constructed home , you may have coverage through a builder’s warranty . These warranties typically last for one to ten years and may cover defects in materials or workmanship that affect the home’s foundation. [1]

Coverage varies significantly by state, builder, and policy. Builder’s warranties often provide protection only for a specific period and may apply only to certain types of foundation damage, such as cracks or settling due to poor workmanship. Extended structural warranties may also cover other load-bearing elements of your home. [1]

If you are considering buying a newly built home, request a copy of the builder’s warranty and review its terms. Ask questions about the coverage period, exclusions, and claim process. If your home was built within the last several years, contact your builder or developer to determine whether your foundation is still covered under their warranty program.

Section 3: Foundation Repair Warranties from Contractors

If your home warranty and builder’s warranty do not cover foundation repairs, you may be able to secure protection through a foundation repair warranty offered by the contractor who performs the work. [5]

Source: pinnaclefoundationrepair.com

These warranties are typically provided after foundation repairs are completed and can cover materials and workmanship . Coverage terms, duration, and transferability vary widely among contractors and states. Some companies offer lifetime transferable warranties, while others may provide coverage for a set period. Always read the fine print and understand what is-and isn’t-covered, including any secondary costs the contractor may charge for accessing the foundation. [5]

Implementation Steps:

- Request a detailed copy of the warranty prior to hiring a foundation repair contractor.

- Ask specific questions about coverage, exclusions, and claim procedures.

- Confirm whether the warranty is transferable to future homeowners.

- Keep documentation of repairs and warranty agreements in a safe location.

Example: In states like North Carolina and South Carolina, many foundation repair companies offer comprehensive warranties covering both labor and materials, which can be transferable if you sell your home. [5]

Section 4: Homeowners Insurance and Foundation Repair Coverage

While standard home warranties generally exclude foundation repairs, homeowners insurance may provide coverage for foundation damage-but only if caused by a covered peril , such as fire, tornado, or sudden water damage. [3]

Common covered perils include:

- Windstorms, hail, or tornadoes

- Lightning strikes

- Vandalism

- Sudden water damage (such as a burst pipe)

- Trees falling on your home

- Fire

Notably, foundation damage from earthquakes and floods is not covered under standard policies . You may need to purchase separate earthquake or flood insurance for such protection. [3]

Guidance for Homeowners: If you suspect foundation damage resulting from a covered peril, document the incident thoroughly, contact your insurance provider, and initiate a claim. For earthquake or flood risks, speak with your insurer about available endorsements or stand-alone policies.

Section 5: Proactive Maintenance and Alternative Protection Strategies

Given the limited coverage for foundation repairs under standard home warranties, proactive maintenance is crucial. Regularly inspect your foundation for signs of trouble, such as cracks, uneven floors, or water pooling near the house. [4]

Effective preventive steps include:

- Monitoring moisture levels around your foundation

- Ensuring gutters and downspouts direct water away from the home

- Addressing drainage issues promptly

- Checking for tree roots near the foundation

- Repairing minor cracks early to prevent escalation

If you live in an area prone to foundation problems, consider consulting a structural engineer or foundation specialist for a professional assessment. Some contractors offer inspection services and can recommend tailored solutions, including waterproofing or soil stabilization.

Alternative Approaches: If you cannot secure coverage through a home warranty, builder’s warranty, or contractor’s warranty, investigate specialized structural warranties from third-party providers. These products may offer protection for major structural components, including foundations, but coverage terms and costs vary. Always compare options, read policy details, and consult industry experts when evaluating structural warranty products. [1]

Source: pinnaclefoundationrepair.com

Section 6: How to Access Foundation Repair Services and Coverage

For homeowners seeking foundation repair or coverage, follow these step-by-step strategies:

- Review your current home warranty and homeowners insurance policies for any relevant coverage or endorsements. Contact your providers for clarification if needed.

- If you own a new home, request information about the builder’s warranty from your builder or developer. Obtain documentation specifying coverage limits and claim procedures.

- Research local foundation repair contractors and inquire about warranty options. Ask for references and examples of previous work.

- Request a professional assessment of your foundation before damage escalates. Many contractors offer free or low-cost inspections.

- Document all repairs and warranty agreements. If you sell your home, provide these documents to the new owner to facilitate warranty transfer (if applicable).

- For additional protection, explore structural warranty products offered by third-party providers. Use search terms such as “structural warranty” or “foundation warranty” and consult with reputable insurance brokers or specialty warranty firms.

If you cannot find a verified website for a specific product, use the official channels of major home warranty providers, insurance companies, and foundation repair specialists. When seeking structural warranty products, search industry directories or consult your local homeowners association for referrals.

Key Takeaways

In summary, standard home warranties do not cover foundation repairs . Builder’s warranties may offer limited coverage for new homes, and foundation repair contractors often provide their own warranties on completed work. Homeowners insurance may cover foundation damage caused by covered perils, but specialized endorsements or policies are needed for earthquake and flood risks. Proactive maintenance and early intervention remain your best defense against costly foundation issues. Always verify the terms of any warranty, insurance, or coverage option, and consult industry experts before making decisions about foundation protection.

References

- [1] Cinch Home Services (2024). Does a home warranty cover foundation repair?

- [2] NerdWallet (2025). Does a Home Warranty Cover Foundation Repair?

- [3] Progressive (2025). Does Home Insurance Cover Foundation Repair?

- [4] Liberty Home Guard (2025). Does a Home Warranty Cover Foundation Repair?

- [5] Foundation Repair Services. What Does a Foundation Warranty Cover?

MORE FROM 9scholarships.de